Health

Things to Think About When Buying Top-up Health Insurance

Individuals are adding more coverage to their health insurance plans to augment what they already have, but doing so necessitates carefully weighing several variables. Tell us the important considerations that any consumer should have before buying a top-up health plan.

Top-up health insurance policy

A top-up policy is a type of health insurance that offers more coverage for medical costs at a reasonable cost. The top-up plan offers extra coverage after the basic health insurance policy’s coverage limit is reached.

Things to think about before purchasing a top-up health insurance policy

- Recognizing the coverage you currently have

Examine the extent of your health insurance policy’s deductibles, co-pays, and coverage limits to find any potential gaps before looking into top-up options. You can identify the precise needs that a top-up plan should take care of with the aid of this assessment.

- Coverage amount

With top-up plans, there are no restrictions on the amount of coverage you can choose. This is helpful if you think your future medical costs will increase.

- Network of healthcare providers

A large number of top-up plans come with a network of hospitals, clinics, and other healthcare facilities. Find out whether the medical facilities you prefer are covered by the plan and how to avoid any potential annoyances or extra expenses.

- Pre-existing conditions and waiting periods

Waiting periods are frequently imposed by insurers before specific conditions, especially for pre-existing medical conditions. Examine the policy documents carefully to comprehend these restrictions and see if they suit your timetable and healthcare requirements.

- Claim settlement process

Examine the insurance company’s track record and reputation for quickly resolving claims. Examine customer reviews, ratings, and feedback from reliable sources to determine how responsive the company is and how it handles claims.

- Tax advantages

Section 80D of the Income Tax Act provides tax benefits for top-up health insurance plans. The premiums you pay for top-up health insurance plans qualify for a tax deduction, which can lower your taxable income.

-

Education3 weeks ago

Education3 weeks agoBelfast AI Training Provider Future Business Academy Reaches Milestone of 1,000 Businesses Trained

-

Tech4 weeks ago

Tech4 weeks agoJonathan Amoia’s Insights on the Intoxication of Artificial Intelligence

-

Business4 weeks ago

Business4 weeks agoAdel En Nouri’s Tips for Writing a Business Plan in 2026 That Actually Works

-

Health4 weeks ago

Health4 weeks agoTolga Horoz: How Developing an Interest in How People Solve Problems Shapes Better Thinking and Innovation

-

Sports2 weeks ago

Sports2 weeks agoUnited Cup 2026: Full Schedule, Fixtures, Format, Key Players, Groups, Teams, Where and How to Watch Live

-

Cryptocurrency4 weeks ago

Cryptocurrency4 weeks agoWhen Crypto Markets Calm Down: How NB HASH Builds Stable Passive Income Through AI Computing Power

-

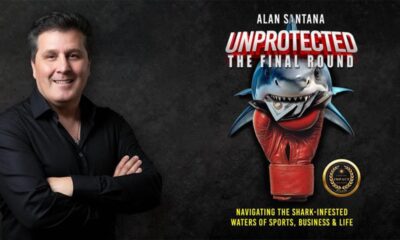

Book2 weeks ago

Book2 weeks agoAuthor, Fighter, Builder: How Alan Santana Uses His Life Story to Empower the Next Generation Through UNPROTECTED

-

Health3 weeks ago

Health3 weeks agoNew Research and Treatments in Motor Neurone Disease