Business

How To Locate and Apply For A Small-dollar Loan In Three Steps

Small dollar loans are low-cost, short-term installment loans with a maximum term of $2,500 that are intended for borrowers with bad credit or no credit. Although the application procedure is expedited because to their extensive federal and state regulation, each bank may have different criteria.

Small dollar loans are comparatively easier to be approved for than regular loans. Still, since they’re not as readily available as conventional personal loans, you’ll need to look into your alternatives.

1. Examine Your Choices

Not every financial organization takes part in the Small Dollar Initiative. However, because of their growing popularity, small dollar loans are now more accessible. Take into account the following choices when searching for this kind of loan:

Choose a few national banks. Within the previous five years, modest dollar loans to consumers have been made available by six of the eight main national banks. By 2023, consumers can obtain small-dollar loans from Bank of America, Huntington Bank, Regions Bank, Truist, U.S. Bank, and Wells Fargo.

Neighborhood credit unions or banks. Ask about and contrast small-dollar loan offers from neighborhood banks and credit unions if you’re currently a customer or would rather use a local lending institution. Since these organizations typically have more lenient lending standards than national banks, getting a small loan from them might be simpler.

For small-dollar loans, institutions need borrowers to have an account. You must join the credit union if you decide to take out a loan from them. The standards, which depend on things like association, locality, and occupation, are usually simple to meet. In exchange for membership, certain credit unions might also take contributions to a particular nonprofit.

Nevertheless, since the process will be much faster, it’s usually a good idea to begin your search with an institution with which you already have an account.

2. Verify Your Eligibility

The approval of a small dollar loan is determined by your current banking activity, as opposed to traditional underwriting, which largely considers your credit score and history. Along with income and work history, account details such as withdrawals, deposits, overdrafts, and account status are taken into account.

The Small Dollar Loan Program stipulates that loans must be “underwritten with standards that consider the consumer’s ability to repay,” notwithstanding the basic conditions for loan approval.

These are some of the most typical conditions that borrowers must fulfill, however the documentation requests may differ:

- Have at least eighteen years old.

- Possess an identity granted by the government.

- Maintain a current checking account (with a participating bank) under your legal name.

- Send in a minimum of two recent pay stubs.

- Withstand a verification of employment check.

Furthermore, you are not eligible for an instant loan upon opening an account if you do not already have a checking account with a partner bank or credit union. As to Pew’s affordable credit brief, “some smaller banks and credit unions will lend based on as little as one month of account history, while the major banks that offer small loans all require at least three months of account history before customers can be eligible for these loans.”

3. Submit An Application and Get Your Money

The bank’s mobile banking app or the internet are the two ways to finish the applications. If you would rather receive help in person, give your local branch a call and find out if customer service is offered.

It should just take a few minutes to finish the application because of the streamlined underwriting procedure. Ensure you have the required paperwork and information on hand to streamline the procedure.

As soon as you submit the necessary paperwork, you should receive the results of your application within one working day, or 24 hours. After you’re authorized, the money will be put into your account and you’ll sign any relevant loan agreements.

When To Apply For A Small-loan

Payday loans and other emergency loans are frequently replaced by small-dollar loans. This is due to the fact that they have more cheaper rates, a more acceptable repayment period, and rapid funding.

Their lower restriction means that they might not be the best option for everyone. For example, small-dollar loans might be the best way to cover some medical costs and a cheap auto or home repair.

A conventional personal loan can be a better option if you need to borrow money for reasons other than emergencies. For people with poor credit, some lenders—especially those operating online—offer loans with terrible credit. Even while these loans are typically more expensive than small-dollar loans, borrowers are able to use them more freely. Compared to small dollar loans, these loans have substantially larger amounts and longer repayment terms.

-

Travel4 weeks ago

Travel4 weeks agoBwindi’s Gorilla Tourism: Saving Wildlife, Empowering Communities

-

Education4 weeks ago

Education4 weeks agoJoseph Curran: Using Legal Writing and Advocacy to Simplify Complex Issues for Clients

-

Tech4 weeks ago

Tech4 weeks agoGoogle Offers New Travel-related Features To Search And Launches Its AI “Flight Deals” Tool Around The World

-

Business4 weeks ago

Business4 weeks agoStop the Bleeding: How Unanswered Comments Increase Your CAC

-

Cryptocurrency2 weeks ago

Cryptocurrency2 weeks agoRami Beracha Asks, Can Israel Become A Global Leader In Blockchain Innovation?

-

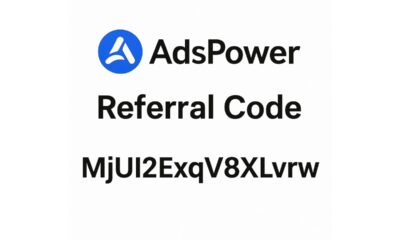

Tech3 weeks ago

Tech3 weeks agoAdsPower Promo Code for 50% Off – Ultimate Guide to AdsPower Benefits (Referral Code Included)

-

Education2 weeks ago

Education2 weeks agoForged in Fire: Nicholas Lawless Unveils Lawless Leadership – The Model Built for a World That Traditional Leadership Can’t Survive

-

Business2 weeks ago

Business2 weeks agoOPO Group LTD Strengthens Its Global Footprint With Expanding Offices and a Modernized Trading Ecosystem