Real Estate

How to Choose Investment-Grade Real Estate: 5 Tips to Help You

Rentable real estate is one asset you might want to include in your portfolio as you accumulate wealth. By generating some passive income now, these investment properties can be excellent for accumulating wealth later on. Here are five suggestions for selecting a quality new property when the time comes.

- It Suits Your Budget

To figure out how much property you can afford, you must first perform a financial assessment. A twenty percent down payment is typically required by lenders when buying rental property. The reason for this is that investment properties are viewed by lenders as more hazardous than residential ones. To find out what range you should be looking in and how much you’ll need to pay upfront for the loan, you should get pre-qualified by a lender.

- A positive cash flow

Finding the estimated cash flow of an investment property is essential if you want to turn a profit on it. The first step in doing this is figuring out the potential mortgage payment using your pre-qualification. The estimated rent for a home with a comparable number of bedrooms and bathrooms should then be found. Then, just deduct monthly costs such as your mortgage, property taxes, and insurance from the total rent you will receive from the rental.

- Other Rentals Nearby

It only makes sense that you pick a neighborhood with a high rental rate if you want to profit from your investment property. Examining local rental listings is a great way to get a sense of these areas. As this will indicate that there is a new pool of renters who do want to live in that locality, make sure there are a few different rentals in the area you are looking to buy.

- Be Aware of the Appliances’ Age

A home needs functional appliances to be livable. It’s best to inquire about the age of all the appliances, especially the larger ones like a furnace or central air conditioning unit when you first start looking for a rental home.

You want to make sure they last a long time, or you want to sell the property for a fair price and buy new appliances soon after. You don’t want to be forced to pay market value for a home whose major appliances will soon need to be replaced.

- Check local rates of vacancy

There are plenty of rentals in the area where you can find a property. On the other hand, it may be a sign that tenants are leaving the area if most of the local rentals are empty. This is especially typical when large corporations relocate their larger stores and warehouses. Renters relocate because they are unable to find employment.

Keep an eye out for high rates of vacancy, as it will probably be difficult to find a tenant in any of these areas.

One excellent method to create long-term wealth is to put your money into investment real estate. But you should make sure you read through the above advice before you go out and buy the first one you see. In this manner, you can be guaranteed to receive a quality investment property every time.

-

Education4 weeks ago

Education4 weeks agoBelfast AI Training Provider Future Business Academy Reaches Milestone of 1,000 Businesses Trained

-

Tech4 weeks ago

Tech4 weeks agoJonathan Amoia’s Insights on the Intoxication of Artificial Intelligence

-

Sports3 weeks ago

Sports3 weeks agoUnited Cup 2026: Full Schedule, Fixtures, Format, Key Players, Groups, Teams, Where and How to Watch Live

-

Health4 weeks ago

Health4 weeks agoTolga Horoz: How Developing an Interest in How People Solve Problems Shapes Better Thinking and Innovation

-

Cryptocurrency4 weeks ago

Cryptocurrency4 weeks agoWhen Crypto Markets Calm Down: How NB HASH Builds Stable Passive Income Through AI Computing Power

-

Book3 weeks ago

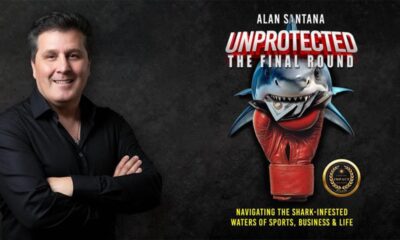

Book3 weeks agoAuthor, Fighter, Builder: How Alan Santana Uses His Life Story to Empower the Next Generation Through UNPROTECTED

-

Health3 weeks ago

Health3 weeks agoNew Research and Treatments in Motor Neurone Disease

-

Science3 weeks ago

Science3 weeks agoJanuary Full Moon 2026: Everything You Should Need to Know, When and Where to See Wolf Supermoon