Business

How SIP in Mutual Funds Contributes To Wealth Creation is Explained

Money into systematic investment plans (SIPs) currently totals close to Rs 19,000 crore per month.

Fixed-income investments are ideal since they guarantee returns and safeguard your principal. The main issue with them is that a lot of them don’t outperform inflation in the long run. Investing in SIP is a solid approach in this case. An SIP, which allows an investor’s money to be invested in a mutual fund over time at predefined intervals (such as months or quarters), helps develop wealth regardless of the size of the investment amount.

To produce income on both the initial investment and the income earned, think of investing in an asset, getting a return on it, and then reinvesting the earnings. By continuing this reinvestment cycle, one can benefit from the initial investment as well as all of its returns. Compounding is the term for this reinvestment cycle. The snowball effect is a common comparison for it. Over time, little actions can add up to big outcomes.

Investors can profit from both their initial investment and any future income they earn with SIP investment plans thanks to the power of compounding. Take a look at the following sample to gain a better understanding of this. Suppose, instead of investing in a SIP plan, you put Rs 12,000 in a traditional investment vehicle and receive 10 percent interest for a period of three years. At the conclusion of the three-year period, you will get an interest payment of Rs 3,600. However, if you put Rs 1,000 into a monthly SIP investment plan that has compound interest and offers 10 percent interest, you can end up with higher profits after three years.

Start Early: Compounding’s true potential is dependent on time. If investors begin their SIPs early and continue with them, they will be able to fully reap the benefits of compounding. Even small, regular payments over time might add up to a sizable amount of money. Compounding power’s effect depends on a person’s investment horizon. If you extend your investing horizon, you will have more time for your interest income to accumulate and provide substantial returns. For example, two individuals begin contributing to a SIP with the same amount of money at ages 25 and 35, respectively. Even if the later investor makes contributions for an extra ten years, the earlier investor usually ends up with a larger corpus because of the longer period of compounding.

Retain consistency: One of the most important aspects of SIP investment is consistency. Rupee cost averaging can help if a certain amount is contributed consistently, even in the event of market volatility. The capacity to average a purchase’s cost over time by making a regular financial investment is known as rupee cost averaging. SIPs typically assign a fixed amount to a plan, with units awarded to investors according to their net asset value (NAV). As a result, the acquisition’s total cost is reduced, and one can average expenses throughout fluctuations in the market. It’s also crucial that there be no abrupt withdrawals. If assets are liquidated before the investment period, the investor can forfeit the compounding benefits accumulated up to that point.

Invest Regularly: Investors must make timely SIP payments in order to accumulate a sizable corpus from their investment portfolio. Individuals can achieve their investment goals relatively quickly by practicing regular investing and gradually raising the investment amount. Reinvesting returns and allowing the money to grow over time can often generate larger amounts of wealth than other investment vehicles. To properly take advantage of compounding through SIP, one must be patient and dedicated to their investing strategy.

Over the course of the 14-month investment period, there was a steady growth in wealth thanks to the Rs 1,000 SIP and a Rs 2-lakh one-time investment at a 10% annualized rate of return compounded monthly. The initial balance in the first month is Rs 2,00,000, and after the SIP investment and interest calculation, the compounding amount equals Rs 2,02,675. Over the course of the months, the interest generated and compounding amount climbed dramatically, culminating in a total compounding sum of Rs 2,38,548 after 14 months. The dynamic increase of the investment throughout the given period is captured in this analysis.

SIP: Exposing The Route To Sustainable Wealth Creation

In the current environment, a systematic investment plan (SIP) is seen advantageous. This investing plan simplifies the investor’s entire wealth-creation process by encouraging discipline and consistent investments in top mutual funds. It’s not just a methodical way to invest; it also makes use of compound interest’s amazing power. Sticking with it and starting early are the keys to success. Investors who embrace compounding can lay the groundwork for a secure financial future.

-

Travel4 weeks ago

Travel4 weeks agoBwindi’s Gorilla Tourism: Saving Wildlife, Empowering Communities

-

Education4 weeks ago

Education4 weeks agoJoseph Curran: Using Legal Writing and Advocacy to Simplify Complex Issues for Clients

-

Tech4 weeks ago

Tech4 weeks agoGoogle Offers New Travel-related Features To Search And Launches Its AI “Flight Deals” Tool Around The World

-

Tech3 weeks ago

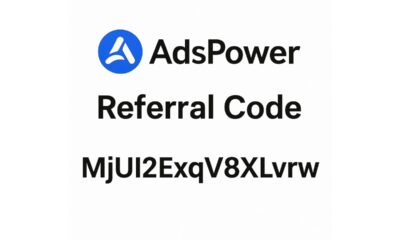

Tech3 weeks agoAdsPower Promo Code for 50% Off – Ultimate Guide to AdsPower Benefits (Referral Code Included)

-

Business4 weeks ago

Business4 weeks agoStop the Bleeding: How Unanswered Comments Increase Your CAC

-

Cryptocurrency2 weeks ago

Cryptocurrency2 weeks agoRami Beracha Asks, Can Israel Become A Global Leader In Blockchain Innovation?

-

Education2 weeks ago

Education2 weeks agoForged in Fire: Nicholas Lawless Unveils Lawless Leadership – The Model Built for a World That Traditional Leadership Can’t Survive

-

Business2 weeks ago

Business2 weeks agoOPO Group LTD Strengthens Its Global Footprint With Expanding Offices and a Modernized Trading Ecosystem