Startup

Does Shop Pay Check Credit? It Depends – Here’s How it Works

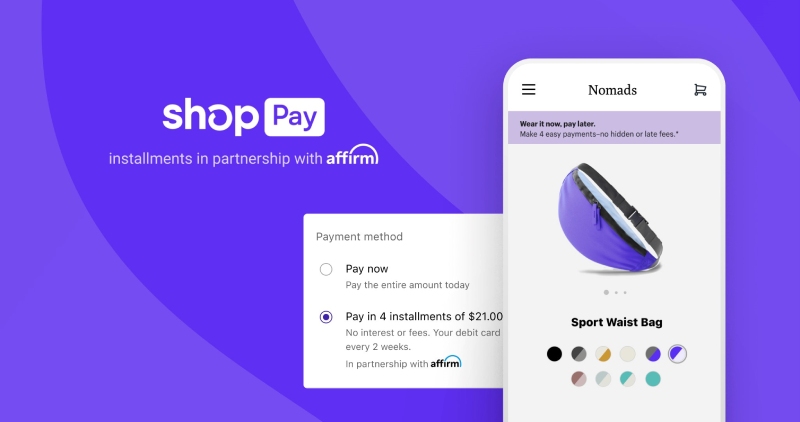

Shop Pay, a novel payment service from Shopify, is gaining traction in the world of online shopping. While it promises faster checkouts and flexible payment options, many users wonder how Shop Pay might impact their credit score and overall financial health.

In this comprehensive guide, we’ll explore everything you need to know about Shop Pay, including whether it checks your credit.

Short answer: Shop Pay Installments may perform a soft credit check when used, which doesn’t impact your credit score. However, regular Shop Pay transactions, like one-time purchases, don’t involve any credit checks and won’t affect your credit.

What is Shop Pay?

Shop Pay is an innovative online payment service developed by Shopify. It is designed to make online shopping faster and more convenient. It not only accelerates the checkout process by remembering your shipping and payment information but also allows you to track your orders and returns in one place.

How Does Shop Pay Work?

Shop Pay is designed to streamline the online shopping experience. It offers a one-click payment service that saves your shipping and billing information, making future checkouts fast and hassle-free. Furthermore, Shop Pay provides an installment payment option, enabling customers to pay for their purchases over time in small increments.

Where Can You Use Shop Pay?

Shop Pay is accepted at thousands of online stores, including popular brands like Fashion Nova, Spanx, and Funko. However, it’s worth noting that the use of Shop Pay is subject to certain restrictions, and it may not be available for all products and services.

Understanding Credit

Before we delve into whether Shop Pay checks your credit, it’s essential to understand what credit is and how it works. Your credit score is a numerical representation of your creditworthiness, which lenders use to assess the risk of lending you money. It is calculated based on several factors, including your payment history, the amount of debt you owe, the length of your credit history, and the types of credit you have.

Does Shop Pay Check Your Credit?

One of the most frequently asked questions about Shop Pay is whether it checks your credit. The answer to this question is nuanced. Shop Pay does not perform a hard credit check that could impact your credit score. However, if you choose to pay for your purchases over time using Shop Pay’s installment payment option, it may affect your credit depending on the payment schedule and whether you make your payments on time.

Risks and Benefits of Shop Pay

Like many online loans no credit check, using Shop Pay comes with its own set of risks and benefits. On the plus side, Shop Pay offers a fast and convenient checkout process, the ability to pay for purchases over time, and a centralized platform for tracking orders and returns. Moreover, it plants a tree with each transaction, contributing to environmental sustainability.

However, potential risks include the possibility of overspending due to the convenience of one-click payments and installment options, as well as potential impacts on credit for those who choose to pay in installments and fail to make payments on time.

Tips for Responsible Use of Shop Pay

Using Shop Pay responsibly involves managing your spending, making timely payments if you choose the installment option, and regularly checking your order status and return options. It’s also advisable to consider other payment options if you are concerned about potential impacts on your credit score.

Real-World Examples

Many Shop Pay users have reported positive experiences with the service. For example, some users have praised Shop Pay’s convenience and user-friendly interface, while others have appreciated the installment payment option, which has allowed them to manage their budget more effectively. However, it’s essential to remember that individual experiences may vary, and it’s crucial to use Shop Pay responsibly to avoid potential credit impacts.

Conclusion

In conclusion, Shop Pay offers a convenient and user-friendly payment service for online shoppers. While it does not perform a hard credit check, using Shop Pay’s installment payment option may impact your credit depending on your payment behavior. As with any financial tool, it’s essential to use Shop Pay responsibly and consider your financial situation and credit health before making purchases.

Whether you’re a frequent online shopper or just an occasional one, understanding how Shop Pay works and its potential impacts on your credit can help you make informed decisions and enjoy a smoother and more convenient shopping experience.

-

Business3 weeks ago

Business3 weeks agoPrakash and Kamal Hinduja: Driving Social and Environmental Change

-

Education4 weeks ago

Fred DuVal: University Leadership as a Critical Resource for Climate Change Research and Life-Saving Solutions

-

Health3 weeks ago

Health3 weeks agoThe Hinduja Brothers Commitment to Global Health: Empowering Communities Across Borders

-

Cryptocurrency3 weeks ago

Cryptocurrency3 weeks agoDesigned For The Masses: How Akasha (AK1111) Is Unlocking Crypto For The Next Billion Users

-

Cryptocurrency4 weeks ago

Cryptocurrency4 weeks agoNexaglobal & Future World Token (FWT): Could This Be the Next Big Crypto Investment of 2025?

-

Sports4 weeks ago

Sports4 weeks agoWomen’s NCAA Tournament 2025 Sweet 16: Full Schedule, Fixtures, Teams, Bracket, and How to Watch March Madness Basketball Match Live

-

Startup1 week ago

Startup1 week agoCost-Saving Strategies Every Small Business Owner Should Know to Boost Efficiency

-

Startup3 weeks ago

Startup3 weeks agoMatthew Denegre on the Art of Deal Sourcing: Finding the Right Investment Opportunities