Business

Finance Services in the Middle East are Being Transformed by Digital Asset Custody

Digital asset custody, which provides a simple and safe method for managing and storing digital assets like security tokens and cryptocurrencies, is at the forefront of this shift. Driven by a significant increase in cryptocurrency transactions worldwide—more than 480 percent more in the MENA region by June 2023, according to Chainalysis—this technology is set to revolutionize financial services and bring in a period of never-before-seen opportunity and change.

The Middle East’s rise in digital assets

The Middle East is becoming more and more interested in digital assets, and the United Arab Emirates is becoming a global hub for blockchain technology and cryptocurrency trading. The government of Dubai is committed to creating a safe environment for digital assets, as evidenced by the nearly 40 licensed cryptocurrency businesses operating under the Dubai Virtual Assets Regulatory Authority. In addition, as of November 2022, the Financial Services Regulatory Authority of Abu Dhabi Global Market had licenses for about seven cryptocurrency businesses, including exchanges and custodians, and at least eighteen more were awaiting licenses.

Although figures for the current year are not available, it is clear that since late 2022, the number of licensed cryptocurrency firms under ADGM has increased. Security tokens have a great deal of potential to improve financial inclusion because they represent ownership of real-world assets on a blockchain. Seventy-two percent of Middle Eastern high-net-worth individuals are interested in investing in alternative assets, such as digital assets, according to a PricewaterhouseCoopers report.

The increased interest in blockchain technology can be ascribed to its transparency and immutability, which provide a degree of security and trust that is frequently lacking in conventional financial systems.

Challenges and the role of digital asset custody

Notwithstanding the zeal, difficulties still exist. Institutional investors may find it difficult to invest in digital assets due to regulatory uncertainty, and their reluctance may also be heightened by security concerns sparked by well-publicized hacks on cryptocurrency exchanges.

Between September and November of 2023, multiple significant breaches affected platforms that were involved in both central and decentralized finance, including Mixin Network ($200 million), CoinEx ($43 million), Poloniex Exchange ($130 million), HTX ($113.3 million), and Kyber Network ($54.7 million). Although these occurrences can be worrisome, there is hope. According to TRM Labs’ analysis, the rates of illicit activity experienced by virtual asset service providers in nations with comprehensive licensing and supervision regimes are lower than those in less regulated areas.

This emphasizes how crucial digital asset custody is for managing and storing digital assets because it offers institutional-grade security. Companies such as Liminal ensure asset safety by utilizing industry-leading security protocols, such as multi-signature key management, strong access controls, cold storage infrastructure, and regulatory compliance.

Custodians like Liminal provide many benefits in addition to security. By getting rid of manual procedures, they simplify digital asset management, which speeds up settlements and reduces operating expenses. Furthermore, their emphasis on regulatory compliance guarantees that assets are managed by the most recent legal requirements, building confidence and drawing in institutional investors. The market for digital assets is made more stable and legitimate by this increased participation.

Transforming financial services in the Middle East

The custody of digital assets is essential for security and for realizing the full potential of digital assets, which will transform the Middle Eastern financial scene. Here are some details about how this change will manifest itself:

- Financial inclusion: The unbanked population’s growth and economic participation are encouraged by digital assets, which provide safe and reasonably priced financial services.

- Innovation in investment: Tokenization has the potential to open up new investment opportunities in a variety of industries, including infrastructure and real estate, and to promote a more dynamic and varied financial ecosystem.

- Cross-border transactions: The intrinsic efficiency of blockchain technology offers the possibility of quicker and less expensive transactions, which could lower remittance costs in the MENA region, which are estimated to be approximately 6.2%, as per a June 2023 World Bank report. This would improve regional trade and investment.

- Programmable money: Smart contracts driven by blockchain technology can automate financial procedures, reducing expenses and errors while optimizing transaction flow.

The path ahead

Without a doubt, digital finance is the way of the future in the Middle East. The region is well-positioned to spearhead the global digital asset revolution, thanks to digital asset custody solutions that enable secure and compliant participation.

But there are difficulties with this move. Regulations must change to reflect the special needs of digital assets. Governments, financial institutions, and technology companies must work together to foster a strong and thriving ecosystem for digital assets.

-

Tech3 weeks ago

Tech3 weeks ago12 Essential Marketing Tools Every Small Business Owner Should Try

-

Business4 weeks ago

Business4 weeks agoSmart Strategies to Stay One Step Ahead in a Competitive Market

-

Business4 weeks ago

Business4 weeks ago9 Low-cost Marketing Strategies and Ideas That Offer a Good Return on Investment for Small Businesses

-

Startup2 weeks ago

Startup2 weeks agoEssential Tips for New Retail Business Owners to Succeed in a Competitive Market

-

Tech4 weeks ago

Tech4 weeks agoHow Small Business Can Start with Marketing Automation Software

-

Tech5 days ago

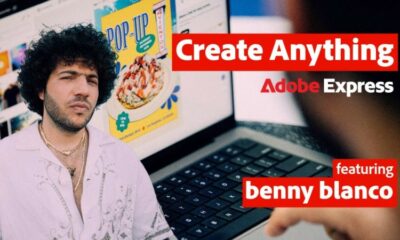

Tech5 days agoAdobe Partner with Benny Blanco to Help Small Business Branding in ‘Create Anything’ Campaign

-

Business3 weeks ago

Business3 weeks ago7 Essential Investment Success Tips Every Investor Should Know: How to Beat the Market

-

Tech3 weeks ago

Tech3 weeks agoGoogle’s Change to Google Local Services Ads Could Have an Impact on Millions of Small Businesses