Startup

How do You Manage Your Finances in Terms of Student Loan Payments?

Because of COVID-19-related legislation, if you have student loans, you most likely received a “payment vacation” during the last few years. However, like millions of other borrowers, you might have just received a call telling you to start making payments again. What impact will this have on your overall financial situation?

The impact on your monthly cash flow is, of course, the first thing that comes to mind. However, the size of the required payments and your income will determine how much pressure you experience. Should these payments truly pose a hardship, you might need to make the necessary modifications to your spending patterns and budget. You might be able to lessen the burden or even shorten the repayment period by taking other actions, though.

Here are some suggestions to think about:

- Set up an automatic payment. Should you fall behind on your student loan payments, you could face late fees and, if you are in serious arrears, even more serious consequences like wage garnishment. Enrolling in autopay, which transfers funds automatically from a checking or savings account to your student loan provider, can help you avoid these issues. Enrolling in autopay can help you not only stay current on your loan but also potentially receive a.25 percent rate reduction, which many lenders and loan services offer.

- Get a loan refinancing. You may be able to lower your interest rate on your student loan by refinancing, which will allow more of your monthly payments to go toward principal, provided you have a reliable source of income, a respectable credit score, and a manageable amount of other debts.

- Check for benefits offered by your employer. Speak with your human resources department to learn if your company offers employee assistance with student loan repayment. Usually, the larger companies do.

- Make additional payments. You might not be able to make additional student loan payments if you’re having trouble just making your regular ones. However, you might be able to pay off your loan sooner than you had anticipated if you can afford to make regular increases to your payments. However, just because you pay more doesn’t mean that your principle will be reduced; student loan services typically apply payments to accrued interest and late fees first. You ought to be able to apply additional payments to the principal when making payments online. There may be other options available to you from your loan servicer to increase your principal payment.

- Select a payout plan. You might want to pay off your student loans strategically if you have multiple loans and can make larger payments than the required minimum. The “snowball” strategy, which involves paying off the smallest loans first, can provide you with a sense of accomplishment and momentum. Alternatively, you could pursue the loans with the highest interest rates first, employing the “avalanche” strategy. In the long run, you might save more money going either way.

Undoubtedly, managing student loan debt can be difficult. But you might be able to assist yourself in moving closer to paying off these loans if you are patient, diligent, and aware of all of your options for repayment.

-

Tech3 weeks ago

Tech3 weeks ago12 Essential Marketing Tools Every Small Business Owner Should Try

-

Business4 weeks ago

Business4 weeks agoSmart Strategies to Stay One Step Ahead in a Competitive Market

-

Business4 weeks ago

Business4 weeks ago9 Low-cost Marketing Strategies and Ideas That Offer a Good Return on Investment for Small Businesses

-

Startup2 weeks ago

Startup2 weeks agoEssential Tips for New Retail Business Owners to Succeed in a Competitive Market

-

Tech4 weeks ago

Tech4 weeks agoHow Small Business Can Start with Marketing Automation Software

-

Tech1 week ago

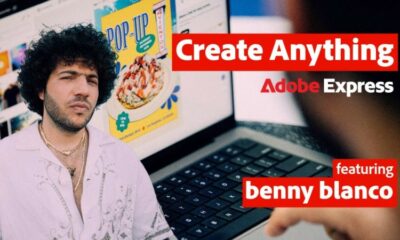

Tech1 week agoAdobe Partner with Benny Blanco to Help Small Business Branding in ‘Create Anything’ Campaign

-

Business3 weeks ago

Business3 weeks ago7 Essential Investment Success Tips Every Investor Should Know: How to Beat the Market

-

Tech3 weeks ago

Tech3 weeks agoGoogle’s Change to Google Local Services Ads Could Have an Impact on Millions of Small Businesses