Real Estate

M&G Completes the £350 Million Debt Financing for Real Estate

The first close of M&G Investments’ most recent real estate debt funds was announced, and the company raised £350 million from four clients. In a press release dated March 11, M&G Investments announced the first close of its Real Estate Debt Funds, which included GBP350 million ($597.19 million) of capital from four institutional clients. A GBP200 million ($341.26 million) investment from LGPS Central Limited and a GBP100 million ($170.63 million) contribution from the Prudential With-Profits Fund make up the total capital raised thus far for this fund.

M&G Investments is a savings and investment company that is a division of the global investment manager M&G, which is headquartered in London and listed on the London Stock Exchange. The investment firm says it will reach out to international institutional investors interested in direct commercial real estate loans in Europe to continue raising additional capital for its Real Estate Debt Funds over the next 18 months.

Four investors contributed the capital, which the real estate finance team at M&G will use to fund real estate loans throughout Europe.

Among the £200 million and £100 million contributions made by UK pension fund LGPS Central and Prudential’s With-Profits fund, respectively, are these four investors.

Two unnamed investors, one of whom was a large UK insurer, contributed the remaining £50 million.

The capital will be used to fund loans for real estate throughout Europe that were started by the real estate finance team at M&G.

With investments of £200 million from LGPS Central Limited, £100 million from the Prudential With-Profits Fund, and £25 million from one of the biggest insurers in the UK, the most recent funds have reached a first close.

Over the next 18 months, M&G plans to raise additional funds for these funds and segregated mandates from international institutional investors looking for double-digit returns on direct commercial real estate loans in Europe.

“We are pleased to reach the first close of our latest funds with strong support from several cornerstone investors,” M&G Investments co-head of real estate finance Dan Riches said. “Rising interest rates have contributed to a reduction in property valuations, providing investors accessing this asset class now with lower debt bases and subsequently greater downside protection and preservation of capital.”

According to Riches, the company is still seeing favorable risk-adjusted returns in the industry, and investors from Asia and Europe are allocating more money to debt and private market investments.

LGPS Central Limited’s head of private markets Nadeem Hussain said: “This investment plays an important role in fulfilling our long-term obligations and objectives and we very much look forward to working closely with M&G’s real estate finance team in the future. Their approach to constructing portfolios and experience in managing this attractive asset class is a key driver of our partnership.”

M&G Investments head of UK institutional distribution Grant Hadland said: “We are pleased to have been selected to manage this capital on behalf of LGPS Central Limited and through this strategic partnership.

“This mandate builds upon our long experience of working with local government pension schemes and UK institutional investors. For those pension funds and institutional investors that can withstand reduced liquidity, certain parts of the private markets universe still offer the potential to lock in higher returns that typically come with lower volatility.”

The last 15 years have seen significant changes in the €1.5 trillion real estate finance market. Previously controlled by the banks, the share of outstanding debt held by alternative lenders has increased to approximately 39% in the UK and between 10% and 15% in Continental Europe.

As banks leave certain areas of the lending markets, it is anticipated that alternative lenders will keep becoming more significant.

As of June 30, 2023, M&G had £74 billion in assets under management, including a real estate finance division that ranks among the biggest alternative lenders in Europe with a clientele that spans the UK, Europe, and Asia.

-

Tech3 weeks ago

Tech3 weeks ago12 Essential Marketing Tools Every Small Business Owner Should Try

-

Business4 weeks ago

Business4 weeks agoSmart Strategies to Stay One Step Ahead in a Competitive Market

-

Startup2 weeks ago

Startup2 weeks agoEssential Tips for New Retail Business Owners to Succeed in a Competitive Market

-

Business4 weeks ago

Business4 weeks ago9 Low-cost Marketing Strategies and Ideas That Offer a Good Return on Investment for Small Businesses

-

Tech4 weeks ago

Tech4 weeks agoHow Small Business Can Start with Marketing Automation Software

-

Tech1 week ago

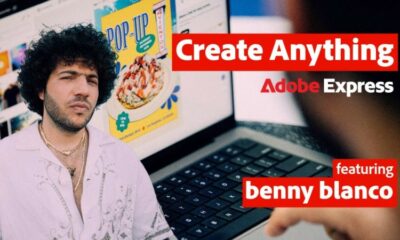

Tech1 week agoAdobe Partner with Benny Blanco to Help Small Business Branding in ‘Create Anything’ Campaign

-

Business3 weeks ago

Business3 weeks ago7 Essential Investment Success Tips Every Investor Should Know: How to Beat the Market

-

Tech4 weeks ago

Tech4 weeks agoGoogle’s Change to Google Local Services Ads Could Have an Impact on Millions of Small Businesses