Business

Citigroup Plans to Grow Its Wealth Management Business in Asia and the Greater Bay Area by Leveraging Hong Kong’s Standing as a Finance Hub

The global wealth head of Citigroup says the company will grow its wealth management business from its base in Hong Kong to the Greater Bay Area and the rest of Asia.

Following a week-long tour of several Greater Bay Area cities, Andy Sieg stated that the US banking group is still dedicated to Hong Kong and China, even after selling its mainland wealth business to HSBC in October.

“The onshore consumer business in mainland China was sold because, similar to other markets where we divested such businesses, it just did not have the necessary scale to compete,” Sieg said. “Having Hong Kong as our base to serve our clients in mainland China is our strategy.

“Our commitment to Hong Kong and to China could not be stronger. We are extremely focused on this region as a source of growth for Citi’s wealth management in the years ahead.”

According to Citigroup, over the next ten years, there will be a $100 trillion global creation of wealth, with Asia experiencing the fastest growth.

“That represents an enormous opportunity for wealth management, and Hong Kong is the epicenter of this global wealth creation,” Sieg said.

By 2025, the banking group hopes to have brought in US$150 billion in new business from the area.

Reunited with Citigroup last September was the seasoned banker. He began his career in 1992 at Merrill Lynch, then spent five years with Citigroup before returning to Merrill Lynch for a further fourteen years until the company was acquired by Bank of America in 2009.

Sieg traveled to meet high-net-worth clients and staff in Guangzhou, Shenzhen, and Hong Kong, as well as a few other cities in the Greater Bay Area.

When questioned about Stephen Roach’s most recent column, in which the former chief economist of Morgan Stanley declared that “Hong Kong is over,” Sieg responded that he strongly disagreed.

“I spent almost a week with our team and clients, and they are all incredibly optimistic about the future of Hong Kong as a market and incredibly energized about the business opportunity for Citi in Hong Kong.

“When we think about the future for our wealth business, Asia is at the very centre and we are very proud of the presence that we have in Hong Kong and Singapore to serve clients in the region.”

The advantage of Hong Kong, he stated, is its proximity to the Greater Bay Area, an economic hub established five years ago by Beijing to unite the city with Macau and nine other mainland cities.

In the upcoming years, Citigroup plans to grow its family office, retail banking, credit card, and private banking operations, according to Sieg.

The Hong Kong government unveiled several initiatives in March 2023 to entice billionaires to establish family offices in the city to pursue investments, philanthropy, and succession planning.

Chief Executive John Lee Ka-chiu has announced several initiatives to draw 200 new family offices by 2025, including tax breaks, art storage facilities, and an updated investment-migration program.

“Hong Kong offers a great base for family offices because it has a combination of deep history as a financial centre and proximity to what is taking place in mainland China,” Sieg said.

According to him, wealthy clients from the Greater Bay Area wish to diversify their investments through Hong Kong, while many international family offices want to use Hong Kong as a stepping stone to invest in mainland China.

In November 2022, the US bank opened its first wealth centre worldwide in the popular tourist destination of Tsim Sha Tsui, hoping to tap into the increasing number of mainland clients. The K11 Atelier Centre opened right before the city’s borders were once again opened following the Covid-19 pandemic.

Consequently, the bank announced that in 2019 there were 61% more new international personal banking customers than there were in the pre-Covid era.

“We see Hong Kong and Singapore as key centres for the future of wealth in Asia,” Sieg said. “They will both be successful markets as the two cities act as a bridge between China and the broader markets of Southeast Asia and the world.”

-

Tech3 weeks ago

Tech3 weeks ago12 Essential Marketing Tools Every Small Business Owner Should Try

-

Business4 weeks ago

Business4 weeks agoSmart Strategies to Stay One Step Ahead in a Competitive Market

-

Business4 weeks ago

Business4 weeks ago9 Low-cost Marketing Strategies and Ideas That Offer a Good Return on Investment for Small Businesses

-

Startup2 weeks ago

Startup2 weeks agoEssential Tips for New Retail Business Owners to Succeed in a Competitive Market

-

Tech4 weeks ago

Tech4 weeks agoHow Small Business Can Start with Marketing Automation Software

-

Tech1 week ago

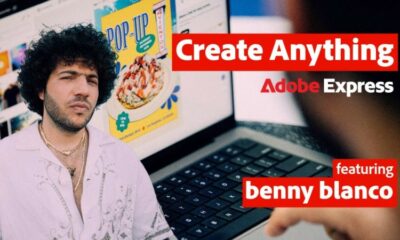

Tech1 week agoAdobe Partner with Benny Blanco to Help Small Business Branding in ‘Create Anything’ Campaign

-

Business3 weeks ago

Business3 weeks ago7 Essential Investment Success Tips Every Investor Should Know: How to Beat the Market

-

Tech3 weeks ago

Tech3 weeks agoGoogle’s Change to Google Local Services Ads Could Have an Impact on Millions of Small Businesses