Business

Jeff Budzik Discloses The Role of a Tax Consultant: How They Can Benefit You

Are you tired of navigating the complexities of taxes on your own? Look no further – a tax consultant can provide expert guidance and help you save money. Staying compliant and optimizing your tax strategy can be daunting, with laws constantly changing. Jeff Budzik will explore how a tax consultant can ease your burden and improve your financial situation.

What Is a Tax Consultant?

A highly experienced tax consultant provides expert advice and support to people or businesses concerning their tax responsibilities and techniques. They have expansive knowledge of tax laws, rules, and policies. A tax advisor can offer valuable guidance on tax planning, ensuring compliance with tax laws and decreasing tax penalties. Their expertise is unique during tax audits or when negotiating intricate tax issues.

What Are the Responsibilities of a Tax Consultant?

We will discuss how a consultant can assist with audit representation, tax resolution, and negotiation, providing valuable support during potentially stressful situations.

Tax Planning and Preparation

Tax planning and preparation are essential to effectively managing your taxes and avoiding potential issues.

- Evaluate your financial situation and sources of income.

- Collect all necessary records, such as W-2s, 1099s, and receipts.

- Choose which beliefs and credits you are eligible for.

- Organize your documents and categorize expenses.

- Calculate your taxable income and tax liability.

- Accurately complete and submit your tax returns before the deadline.

Audit Representation

Audit representation is a crucial responsibility of a consultant. When facing an audit from tax authorities, a tax consultant can provide valuable assistance.

- Reviewing the audit notice and understanding the scope of the audit.

- Gathering all relevant documents and records requested by the tax authorities.

- Preparing and organizing the necessary information to support your tax positions.

- Communicating and negotiating with the tax authorities on your behalf.

- Attending meetings and hearings related to the audit.

Tax Resolution and Negotiation

Tax resolution and negotiation are crucial responsibilities of a tax consultant. Here are the steps involved in this process:

- Evaluate the tax situation: The consultant carefully evaluates the client’s tax issues, including unpaid taxes, penalties, or audits.

- Develop a strategy: The consultant creates a customized plan to effectively resolve the client’s tax problems, considering their financial situation and goals.

- Communicate with tax authorities: The consultant serves as a representative for the client in all communication with tax authorities, skillfully negotiating on their behalf.

- File necessary paperwork: The consultant prepares and files any required paperwork, such as amended tax returns or settlement proposals.

- Negotiate tax settlements: Through negotiation, the consultant works towards a favorable resolution with the tax authorities, such as an installment agreement or an offer in compromise.

Why Should You Hire a Tax Consultant?

This section will discuss why hiring a tax consultant can benefit you. From their expertise and knowledge to the peace of mind they can provide, we’ll explore how their services can save you time, money, and potential penalties.

Expertise and Knowledge

A consultant offers expert guidance and knowledge on tax-related matters. There are the actions to think about:

- Assess your specific tax needs and goals.

- Research and identify consultants who specialize in your area of interest.

- Arrange consultations to discuss your tax situation and assess their expertise.

- Ask specific questions to evaluate their knowledge and problem-solving abilities.

- Evaluate their ability to communicate complex tax concepts clearly and understandably.

- Consider their availability and responsiveness to your inquiries.

- Compare fees and determine if the value provided aligns with your budget.

- Make an informed decision based on the consultant’s expertise, experience, reputation, and cost.

Time and Cost Savings

Hiring a consultant regarding tax can lead to substantial time and cost decreases.

- Efficient tax preparation: Consultants have expertise in tax laws and regulations, ensuring accurate and timely filing.

- Strategic tax planning: They identify deductions, credits, and exemptions to minimize tax liability, maximizing savings.

- Reduced risk of errors: Consultants handle complex calculations and documentation, minimizing the risk of mistakes or penalties.

- Time-saving recordkeeping: They organize financial records, saving time during tax season and ensuring compliance.

Avoiding Mistakes and Penalties

When it comes to taxes, avoiding mistakes and penalties is crucial. Hiring a tax consultant can help you navigate the complexities of tax laws and regulations. Here are some steps to prevent errors with the help of a consultant:

- Ensure accurate record-keeping of income, expenses, and deductions.

- Stay updated on tax laws and regulations to ensure compliance.

- File tax returns on time and pay taxes promptly.

- Seek guidance from a consultant for complex tax situations.

- Review tax returns for errors and inconsistencies before submission.

How to Choose the Right Tax Consultant for You?

Experience and Credentials

When choosing a tax consultant, considering their experience and credentials is vital. Here are a few actions to guide you in the procedure:

- Research their experience: Look for consultants with several years of experience in tax consulting.

- Check their credentials: Ensure they are certified or licensed in tax consulting, such as Enrolled Agent or Certified Public Accountant.

- Review their education: Seek consultants with relevant degrees or certifications in accounting or tax law.

- Consider their specialization: Determine if they have expertise in the specific area of tax that you require assistance with, such as international or small business tax.

Specialization and Services Offered

When picking a tax consultant, it is vital to consider their area of profession and the benefits they provide.

- Pinpoint your exact tax needs, whether for personal or business taxes.

- Research consultants with expertise in your particular area of focus, such as corporate tax or international tax.

- Consider their services, such as tax planning, compliance, or representation with the IRS.

- Review their track record and client testimonials to evaluate their experience and reputation.

Reputation and Reviews

When searching for a tax consultant, it is essential to consider their reputation and reviews. Reading reviews from previous clients to understand their satisfaction and experiences is also helpful. Consider testimonials and recommendations from reliable sources. Be cautious of any opposing thoughts or red flags.

A consultant with a solid reputation and positive reviews is more likely to provide trustworthy and effective services. Remember, a consultant’s reputation and reviews can provide valuable insights into their credibility and professionalism.

Cost and Communication

Thinking about cost and communication elements is vital when digging for a tax consultant. To help you make the correct decision, here are some points to consider:

- Research various consultants and compare their pricing structures.

- Consider the level of communication provided by the consultant. Do they promptly respond to your inquiries?

- Check if the consultant offers multiple communication channels like phone, email, or in-person meetings.

- Read reviews or ask for referrals to assess the consultant’s communication skills and professionalism.

- Consult with potential consultants to discuss their fees and communication preferences.

- Ensure that you understand the consultant’s pricing structure and the services included in the cost.

- Select a tax consultant who offers transparent communication and a price that aligns with your budget.

-

Tech3 weeks ago

Tech3 weeks ago12 Essential Marketing Tools Every Small Business Owner Should Try

-

Business4 weeks ago

Business4 weeks agoSmart Strategies to Stay One Step Ahead in a Competitive Market

-

Startup2 weeks ago

Startup2 weeks agoEssential Tips for New Retail Business Owners to Succeed in a Competitive Market

-

Tech4 weeks ago

Tech4 weeks agoHow Small Business Can Start with Marketing Automation Software

-

Tech1 week ago

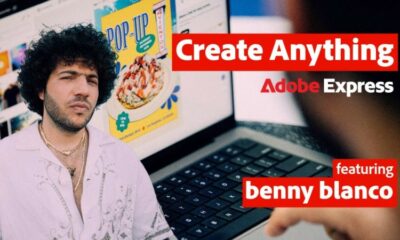

Tech1 week agoAdobe Partner with Benny Blanco to Help Small Business Branding in ‘Create Anything’ Campaign

-

Business3 weeks ago

Business3 weeks ago7 Essential Investment Success Tips Every Investor Should Know: How to Beat the Market

-

Tech4 weeks ago

Tech4 weeks agoGoogle’s Change to Google Local Services Ads Could Have an Impact on Millions of Small Businesses

-

Festivals & Events2 weeks ago

Festivals & Events2 weeks agoKrispy Kreme is Celebrating World Kindness Day by Offering Free Donuts to Early Customers