Business

Brown Finance Review – What is it offering in 2022?

This Brown Finance Review is focused on discussing the services they provide. This evaluation covers every facet of their platform, whether excellent or negative. For your convenience, their security measures, price structure, platform, instruments, educational guide, account kinds, opening limitations, mobile app, customer service, and so on are all covered. Please take a look to possess a thorough understanding of what they have to offer in 2022.

This Brown Finance Review should be enough to aid you in deciding whether or not to utilize their platform. It has addressed every facet of their services, both favorable and negative. The goal of this review is not to advocate their platform but rather to enlighten readers about what they are delivering in 2022. They have been in the brokerage services company since 2010, which means they have been in operation for more than a decade.

The fundamental reason I’m writing this Brown Finance Review is that when I was seeking a trading platform, I couldn’t select between so many possibilities. Undergoing all of them was a time-consuming and complex task for me. My colleague then advised that I try this platform because he had been utilizing it for five years. I wanted to read as many evaluations of Brown Finance as I could find, but I couldn’t locate more than two. Nonetheless, I conveyed my colleague’s advice and developed an account with them.

Right now, I’m producing a Brown Finance review to assist you in locating the best broker for your needs. This article has classified their supplied services into two categories for your ease of comprehension. One of the categories is: what makes Brown Finance an excellent choice. All of its advantages are discussed in this section. The other question is, where does Brown Finance fall short, and where can it improve? All of their excellent characteristics are discussed here.

Let us follow what they have to offer in 2022 before deciding whether it is the best option for you!

Why is Brown Finance a suitable option for you?

This Brown Finance Review will currently go on to highlight all of the excellent qualities of Brown Finance’s services for active traders.

A policy of No Surprising Fees

If you go to Brown Finance’s website, you will follow a separate blog expressly created to offer every detail of their pricing structure. The following categories are defined in the fee and charges section: hedge fund fees, discounts, spreads, ancillary costs, inactivity fees, deposit and withdrawal fees, and overnight funding fees. I appreciate their candor in disclosing every charge for their services in my Brown Finance Review. It is because most brokers levy hidden fees, which seizes all of the pleasure out of trading. They offer a “No Surprise Fee impressive and great policy for current users.

Licensed Broker

According to the website of Brown Finance, they remain the partner of one of the leading Forex Brokers in the world, B-Finance. The parent company is authorized and regulated by the Financial Conduct Authority (FCA) of the United Kingdom as well as it is also licensed by CySEC and CIMA. It means the brokerage services of Brown Finance are pretty secure and safe.

Customer Support

Brown Finance’s customer service is also one of its strong points, thanks to its warm and attentive demeanor. Brown Finance’s customer support is available 24/7 for support and help, as well as to resolve any questions you may have. You may reach them via their website, email, or phone. They barely responded to your queries, but they are also receptive to recommendations. I needed to trade a coin that wasn’t accessible on their platform once. At that time, I submitted an email requesting that cryptocurrency be included, and my request was acknowledged within a few days, and I was allowed to trade that exact coin.

Trading Instruments & Charts

Brown Finance, unlike other brokerage platforms, provides complete transaction execution choices. Some special trading tools include “Auto Sell” and “Stop-Loss,” which can automatically execute orders. They additionally provide a “Self-Trading Account,” in which you possess proper control over your money. Brown Finance provides high-quality trading instruments with customizable charts for your convenience. You may utilize these instruments and customize the charts to suit your trading approach. Another essential feature of their proposed platform is that it supports three languages: French, English, and Dutch.

Mobile Trading

Brown Finance’s compatible mobile trading platform is one of its outstanding features. Their platform is mobile-friendly and can be gained via both the iOS and Android operating systems. Brown Finance claims to allow equal capabilities to their smartphone version via their PC option. The Brown Finance app allows you to perform transactions while on the move. It is always easier and more flexible to use a mobile app for opening, monitoring, and closing deals. Most broker businesses lack this mobile trading function, which is why I included it in the excellent features of my Brown Finance Review.

Account Opening Limit

Brown Finance has a bottom-tier account, I,e Mini Account, with a $1,000 account limit. It is a relatively realistic amount to begin trading with for newcomers. Many broker platforms have a far lower minimum account starting amount. However, I believe that $1,000 is a perfectly realistic starting point. It is because trading CFDs may be dangerous, and investors may choose to employ leverage, which can result in the loss of all cash if not properly handled. While using leverage, it is prudent to have some money in the reserve to provide your trade some breathing room in the event of market volatility. As a result, $1,000 is a reasonable starting point for beginning traders when creating a trading account.

Market Coverage

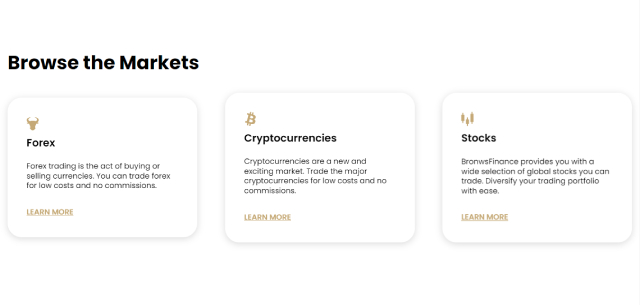

The platform allows access to more than 250 financial products from the Forex, Stocks, Commodities, Indices, and Cryptocurrency markets. Thus this Brown Finance review will emphasize that element of their services. Most platforms solely cater to a unique market, either cryptocurrency or FX, and commodities. Brown Finance, on the other hand, is appropriate for traders who proactively seek to capture all potential moves from all types of markets.

Commission & Spread Fees

The Brown Finance Review already mentions that its pricing structure is extremely extended. It signifies they don’t charge any increased costs. However, another notable feature of Brown Finance is that its commission and spread costs are relatively competitive. They do not charge a hefty commission fee, but their rates are quite inexpensive in comparison to other brokers on the market. Brown Finance is unusual in that they do not charge a commission fee for CFD trading. If you trade CFDs, you may find Brown Finance to remain an intriguing and successful platform.

Where does Brown Finance require enhancements?

The following obtain the points that will demonstrate Brown Finance’s flaws:

There is no Market Update.

My first critique of Brown Finance is a lack of market briefing on their part. As a broker business, they should not neglect such a service and should go to work on it right away. My Brown Finance Review will undoubtedly reveal that they do not provide daily market updates to its Mini Accounts. I can’t declare anything about them because I haven’t used any other accounts with them, and I couldn’t locate anything similar on their website. However, I feel that a broker platform is inadequate if it does not give its clients a market brief.

Center for Education

Although they provide a section for new traders to learn about trading, which is beneficial, possessing all of the written content on one page might be overwhelming for some traders, distinctly modern traders who want to learn about trading. They should, in my opinion, improve the instructional center by making it more engaging. They can include video courses, e-books, and chart references to illustrate with examples. In this way, they may overcome their disadvantage and convert them into a source of power.

There is no Demo Account.

I’d like to conclude my Brown Finance Review by stating that they do not provide Demo Accounts. It may surprise experienced traders, even though it is reasonably conventional. This feature is provided by the majority of broker systems. I was also taken aback to learn that Brown Finance does not provide Demo Accounts. These accounts may be extremely beneficial to both beginners and seasoned traders. I would recommend that they include this service in their extensive list of offerings to rise above the competition.

Conclusion:

I hope this Brown Finance Review provided you with adequate information about their services and platform. All things considered, their platform comprises 80 percent competitive, and they are working to provide more perks. They are a subsidiary of a multi-regulated firm having FCA, CySEC, and CIMA licenses. They have been in the sector since 2010 and have completed over 100 million orders. Brown Finance provides services in about 50 countries throughout the world. Their price structure is straightforward and competitive in a big way. The most prominent part is that you may easily execute transactions using their mobile app.

However, it, like any other firm, has some limitations, such as a no-demo account, no marketing, no market brief, and so on.

As more fraudsters have lately arrived in the industry, I recommend that you undertake extensive research before entering the market through any platform. My Brown Finance Review was intended only to facilitate your research process. I hope it has expanded your understanding of Brown Finance and given you a better idea of what you might want to pursue next. Best wishes with your broker hunt!

Disclaimer:

This review is written from my own experience and my self-knowledge only, and this is not a recommendation.

-

Business2 weeks ago

Business2 weeks agoNayef Doleh Examines International Humanitarian Fundraising Strategies

-

Business3 weeks ago

Business3 weeks agoHow Black Banx is Redefining Global Banking Strategies in 2025

-

Business2 weeks ago

Business2 weeks agoHow to fill MSME Form 1? Step-by-Step Guide

-

Tech4 weeks ago

Tech4 weeks agoHow to Switch Between Microsoft Teams and Skype, How To Export Messages, Files, and Contacts from Skype Before It Shutting Down

-

Tech3 weeks ago

Tech3 weeks agoMicrosoft Teams to End SMS Messaging Feature Support for Android Phones and Switch to Phone Link App as Alternative

-

Education4 weeks ago

Education4 weeks agoSchool Of Odd Thinkers – Think Odd, Learn a lot, and Earn a lot

-

Education3 weeks ago

Education3 weeks agoThe Power of Differentiated Instruction: Patrick Granfar Discusses Its Impact on Student Learning

-

Business2 weeks ago

From Marine to Chief: The Leadership Journey of Sean Mannix