World

Amazon will not stop accepting Visa credit cards in the UK Store on Jan. 19 after all

Amazon said on Monday it would not stop accepting UK-issued Visa Inc (V) credit cards on its British website later this month as it had proposed, adding that it was working with Visa to determine a disagreement regarding payment fees.

Amazon has ended a plan to ban customers using UK-issued Visa credit cards from this week, as the organizations work on a “potential solution” to a malevolent dispute that took steps to seriously disturb customers.

The world’s biggest online retailer reported the proposed ban in November, refering to the “high fees Visa charges for processing credit card transactions,” and advised clients to track down new payment strategies.

With regards to Amazon and cash, never say never. Two days before the e-commerce giant was set to boycott Visa credit cards in its UK store, it has shifted its perspective. Visa credit cards are as yet welcome on the platform, for the present.

“The expected change regarding the use of Visa credit cards on Amazon.co.uk will no longer take place on January 19,” the organization said in an email to clients.

“We are working closely with Visa on a potential solution that will enable customers to continue using their Visa credit cards on Amazon.co.uk.”

Visa affirmed that it was in converses with Amazon to different outlets-Gizmodo contacted the organization’s European division however we haven’t as yet heard back and that clients could keep on using their credit cards meanwhile. (Visa charge cards are not impacted).

The boycott by Amazon was generally viewed as a negotiating strategy and branded “odd” and “unfortunate” by Visa CEO Al Kelly.

Amazon, whose own hold on customers has been reinforced as more individuals shopped online during the pandemic, has been working with elective payment providers to Visa, which close by Mastercard has been a dominant force in payments for decades.

Dissimilar to rivals Mastercard and American Express, Visa doesn’t offer a co-branded Amazon card in the UK. At the point when the boycott was first declared, the co-branded cards were among the choices Amazon proposed to clients.

The sudden truce is good news for Amazon clients in the UK, where nearly 90% shop on the e-commerce site, the Guardian brought up. Furthermore, an expected 21 million are said to have Prime membership. Reports in December expressed that Amazon might have lost up to $1.9 in sales from UK clients. Visa would have been battered by the move too because clients would have been committed to using different cards on Amazon.

The squabble between Amazon and Visa dates to November. That month, irate over rising fees, the e-commerce giant declared it would boycott Visa credit cards on its site starting on Jan. 19. Visa took shots back at the time that Amazon was “restricting consumer choice.”

Amazon has not publicly unveiled which rising fees it doesn’t like, yet Sky News expresses that it is believed the e-commerce platform is distraught over interchange fees, which it claims have expanded five-fold since Brexit. These fees are paid by Amazon or its traders and would diminish profit margins and lead to changes that could expand costs for shoppers.

However, the battle isn’t finished at this point. The two sides are attempting to agree, yet it doesn’t mean they will. (Albeit given boatloads of money included, something lets me know they likely will). Assuming that the discussions disintegrate with no agreement, Amazon said it will surrender clients’ heads.

“Should we make any changes related to Visa credit cards, we will give you advance notice. Until then, you can continue to use Visa credit cards, debit cards, Mastercard, American Express, and Eurocard as you do today,” the organization said in its email to clients.

Toward the finish of 2020, Visa represented 33% of the credit card market in the UK, Mastercard 62%, and American Express the rest of, to the most recent accessible information from UK Finance, the banking and finance trade association.

“Amazon customers can continue to use Visa cards on Amazon.co.uk after January 19 while we work closely together to reach an agreement,” Visa said on Monday.

In the UK, the main banks giving Visa credit cards incorporate Barclays, HSBC, and the Co-operative Bank as well as building society Nationwide.

Amazon’s intercession in November came after payment organizations got away from an EU cap on cross-border interchange fees—a levy credit card organizations charge for the responsible banks-when the UK left the bloc.

Visa last October started charging 1.5 percent of the transaction value for credit card payments made online or via phone between the UK and EU, and 1.15% for debit card transactions, up from 0.3 percent and 0.2 percent respectively.

Amazon said in November that Brexit was not the particular cause of the dispute with Visa, rather accusing the US organization’s fees over the long term.

Amazon has inspected a few elective payment techniques beyond traditional credit cards. Last August, it declared the “buy now, pay later” option for US clients through third-party provider Affirm. In December, Barclays and Amazon revealed a BNPL option called Installments for buys over £100.

The surge in online shopping during the Covid emergency has assisted produce an opening for elective payment providers and seen investors race to back them. British payments group Checkout.com got a $40 billion valuation last week, while US competitor Stripe was valued at $95 billion last March.

In the meantime, Visa and Mastercard are confronting developing tension from financial technology upstarts like Klarna and Afterpay, which offer “buy now, pay later” services that let customers split the expense of their buys over a time of regularly scheduled payments.

“For too long, cards have been retrofitted into online checkouts, creating an invisible web of hidden costs and unwieldy payment structures that affect the cost base of every single retailer,” said Roger De’Ath, head of ecommerce at TrueLayer, which gives a platform for organizations to access open banking.

“This latest twist in the saga certainly shows the power of the Amazon brand,” said Roger De’Ath, head of U.K. at fintech start-up TrueLayer. “Irrespective of the final decision or the solution offered, its initial announcement has now pushed the debate around card fees for merchants into the mainstream.”

-

Tech3 weeks ago

Tech3 weeks ago12 Essential Marketing Tools Every Small Business Owner Should Try

-

Business4 weeks ago

Business4 weeks agoSmart Strategies to Stay One Step Ahead in a Competitive Market

-

Startup2 weeks ago

Startup2 weeks agoEssential Tips for New Retail Business Owners to Succeed in a Competitive Market

-

Tech4 weeks ago

Tech4 weeks agoHow Small Business Can Start with Marketing Automation Software

-

Tech1 week ago

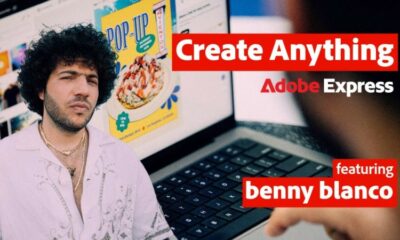

Tech1 week agoAdobe Partner with Benny Blanco to Help Small Business Branding in ‘Create Anything’ Campaign

-

Business3 weeks ago

Business3 weeks ago7 Essential Investment Success Tips Every Investor Should Know: How to Beat the Market

-

Tech4 weeks ago

Tech4 weeks agoGoogle’s Change to Google Local Services Ads Could Have an Impact on Millions of Small Businesses

-

Festivals & Events2 weeks ago

Festivals & Events2 weeks agoKrispy Kreme is Celebrating World Kindness Day by Offering Free Donuts to Early Customers