Business

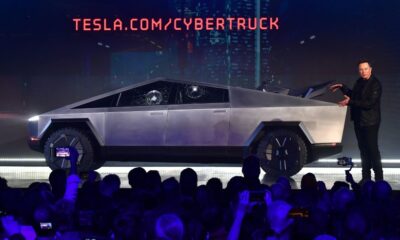

CEO Elon Musk says Tesla has yet not signed an agreement with Hertz

Tesla CEO Elon Musk said on Monday night that his electric vehicle organization presently can’t seem to sign an agreement with rental car organization Hertz. The tweet from Musk went against an earlier declaration and advertisement released by Hertz on Oct. 25.

Elon Musk said Tesla Inc. hasn’t yet signed an agreement with Hertz Global Holdings Inc., notwithstanding the car rental organization last week declaring a record order for 100,000 Model 3 sedans for $4.2 billion.

Broadly, Tesla hit a $1 trillion market cap for the first time a week ago after Hertz declared it would develop its fleet of battery-electric vehicles with “an initial order of 100,000 Teslas by the end of 2022.”

Elon Musk was replying to a tweet from an account named Tesla Silicon Valley Club, which showed a chart of Tesla’s rising stock cost.

“You’re welcome! If any of this is based on Hertz, I’d like to emphasize that no contract has been signed yet. Tesla has far more demand than production, therefore we will only sell cars to Hertz for the same margin as to consumers. Hertz deal has zero effect on our economics,” Elon Musk tweeted.

A commercial featuring seven-time Super Bowl champion Tom Brady, close by stopped Tesla Model 3 electric vehicles in a Hertz garage, went with the declaration.

Interim Hertz CEO Mark Fields last week said the rental organization began conversing with Tesla “many months ago” about the purchase of the vehicles. He depicted it as a “great relationship” and part of Hertz’s transition to lead rental organizations in managing large fleets of EVs.

“This is about relationships. From that standpoint, the Tesla relationship is very important to us, but … we also have relationships with all of the automakers, and we want to help them as they introduce their electrified vehicles,” Fields said during an interview.

Fields, formerly CEO of Ford, depicted the move as a “strategic discussion” to help automakers that began with Tesla and will proceed with different organizations. “We’ve done that with Tesla and our intent is to do that with all of the automakers,” he said.

Investors have traditionally disapproved of automakers when they sell a lot of vehicles to daily rental fleets. That is because cars and trucks offered to rental organizations are typically sold at a discount, with such deals used to lessen bloating inventories and increment their total vehicle deliveries.

In any case, shareholders and investigators reacted well to the idea of Tesla selling 100,000 fully electric vehicles to Hertz. The move was viewed as a sign that battery-electric vehicles were going more standard.

For instance, Wedbush Securities’ Dan Ives wrote in a bullish note about Tesla on Oct. 26:

“The Hertz deal we believe will be viewed as a tipping point for the EV industry as this 100k Model 3′s/$4 billion+ deal for Tesla speaks to more mainstream adoption for EVs as today only 2% of autos in the US are EV driven compared to 10%+ in China with rapid growth on the horizon. We believe this is the biggest transformation to the auto industry since the 1950′s with more consumers heading down the EV path over the coming years.”

Since Tesla’s Oct. 22 close before the declaration, the stock has surged around 33%.

Last week, Elon Musk said it was “strange” the news moved the organization’s valuation to such an extent.

Elon Musk, who owns around 20% of Tesla, has seen his net worth ascend with the electric vehicle creator’s share cost. He is presently the world’s wealthiest person.

Different shareholders within and outside the organization have benefitted, too including long-time bulls like Ron Baron, Tesla representatives who have procured and vested options over time, and Elon Musk’s fellow board members.

Two days in the wake of declaring the initial order of 100,000 Teslas, Hertz said it would make up to half of the vehicles accessible to Uber drivers to rent by 2023. The organization said “if successful,” the program could grow to 150,000 vehicles over the next three years.

Hertz “pointed out that these ambitions could be affected by factors outside of its control, such as semiconductor chip shortages or other constraints.”

During the prospering Covid pandemic, Hertz filed for bankruptcy protection — yet as travel bounced back to somewhat and demand for rental vehicles got, investors from Knighthead Capital Management and Certares Management said they would take over the organization.

Elon Musk’s net worth rose by $24 billion to $335.1 billion Monday as the electric automaker’s shares jumped 8.5% in New York. That enlarged his lead over Amazon.com Inc. Jeff Bezos as the world’s wealthiest person to $143 billion, as per the Bloomberg Billionaires Index. Buffett, chairman of Berkshire Hathaway Inc., ranks tenth with a net worth of $104.1 billion.

Last week, Tesla Inc penetrated a trillion dollars in market capitalization, the fifth U.S. organization to join the club, which incorporates Apple, Microsoft, Amazon, and Alphabet.

-

Business2 weeks ago

Business2 weeks agoNayef Doleh Examines International Humanitarian Fundraising Strategies

-

Business3 weeks ago

Business3 weeks agoHow Black Banx is Redefining Global Banking Strategies in 2025

-

Business2 weeks ago

Business2 weeks agoHow to fill MSME Form 1? Step-by-Step Guide

-

Tech3 weeks ago

Tech3 weeks agoMicrosoft Teams to End SMS Messaging Feature Support for Android Phones and Switch to Phone Link App as Alternative

-

Education4 weeks ago

Education4 weeks agoSchool Of Odd Thinkers – Think Odd, Learn a lot, and Earn a lot

-

Festivals & Events3 weeks ago

Festivals & Events3 weeks agoInteresting Facts about St. Patrick’s Day

-

Business2 weeks ago

From Marine to Chief: The Leadership Journey of Sean Mannix

-

Education3 weeks ago

Education3 weeks agoJeffrey Laino Offers a Close Look at Literary Analysis Implementation