Business

7 Best Tax Advices For Owners

Even though the filing deadline is drawing near, investors still have time to organize their tax situations. Even if investors had to settle most of their tax obligations before the previous year ended, there are still things they should be especially aware of and methods they may save money right now.

These are seven excellent tax suggestions that are still applicable to those who file at the last minute.

1. Make IRA Contributions

One of the last and best opportunities for many working Americans to reduce their taxes once the calendar year ends is to make a contribution to a regular IRA. You can still select for a Roth IRA, even if it’s a backdoor Roth IRA, if your income is too high to qualify for a tax break on a standard IRA.

You can make pre-tax contributions to a traditional IRA, which means you won’t be taxed on the money you give. You won’t pay taxes on the money until you withdraw it in retirement after years of tax-deferred growth. With a Roth IRA, you contribute after-tax income, so there is no tax break now, but after retirement, you can take advantage of tax-free withdrawals and growth on your funds.

For those under 50, the maximum contribution to an IRA in 2023 is $6,500. Older contributors (50 years and over) are eligible to add a $1,000 catch-up payment. In 2024, the donation cap will rise to $7,000.

However, it’s crucial to understand that IRAs have income restrictions. A Roth IRA may still be able to provide you with an alluring tax benefit even if your income is too high to qualify for tax deductibility from a standard IRA. If your income is too high for a Roth IRA, you may need to use the backdoor Roth IRA, which lets employees convert their accounts but with some restrictions.

2. Fund Your Retirement Account If You Work For Yourself

You can benefit from tax advantages if you operate your own firm, even if it’s a sole proprietorship, by making contributions to self-employed retirement plans like a solo 401(k) or SEP IRA. Both have substantial contribution caps that can assist you in lowering your current tax liability.

For single-person enterprises, the solo 401(k) operates similarly to a standard 401(k). It is available in two flavors: a standard form that offers tax-deductible contributions together with tax-deferred growth, and a Roth version that lets you accumulate money without paying taxes and take it out tax-free when you retire. You can receive additional tax benefits by contributing to both a standard IRA and a single 401(k).

An individual or small business can participate in the SEP IRA plan, which operates similarly to a standard IRA but allows for substantially larger maximum contributions. You can receive tax benefits from both contributions made to a normal IRA and SEP IRA, as there are no restrictions on any kind of contribution.

There are contribution caps for the single 401(k) and SEP IRA, so you’ll need to pay special attention to the guidelines. The solo 401(k) and SEP IRA differ in the following ways; let’s see which is perhaps superior.

3. Make The Most of Your HSA

Although it’s simple to forget, a health savings account (HSA) can help you save money on taxes. Additionally, you’ll continue to accumulate money for future medical bills. However, this choice is limited to individuals with high-deductible health plans.

Contributions can be made up until the tax deadline, with the individual and family HSA contribution caps for 2023 set at $3,850 and $7,750, respectively. A family with two spouses over 55 may contribute up to $9,750 as each spouse over 55 adds $1,000 to the contribution cap.

If you are able to stash away that much cash, it would be some significant tax savings. Plus, since withdrawals from your HSA are permitted for any purpose once you turn 65, you can use it as an extra retirement plan. However, withdrawals utilized for non-medical expenses will be subject to taxes.

4. Declare Capital Losses, But Avoid Being Caught Off Guard By Wash Sales

Make sure you include any losses on your return when you declare any stock or even property sales. Your tax liability may be decreased in the end by capital losses offsetting capital gains. It is actually possible to assert a net loss on your return of up to $3,000, so be sure to declare any losses.

But while you’re at it, avoid getting caught up in the wash-sale rule. When you sell something for less than you paid for it and then buy it again within 30 days of the sale, it’s known as a wash sale. Even though you haven’t sold your interest in the asset, the wash sale gives the impression that you have. Sales of wash products are expressly not eligible for reimbursement upon return.

Should you attempt to assert a wash sale, the IRS will kindly adjust your return and issue a bill, if required.

However, the loss from a wash sale does not disappear permanently. You can declare a loss and receive your tax benefit once you ultimately sell the asset and don’t buy it back for 30 days.

5. Report Your Bitcoin Profits and Losses

If you invest in cryptocurrencies, you will need to record any realized gains—that is, profits from selling a position—as well as the fact that you traded them in 2023. However, investors should also make sure to claim any losses they may have incurred due to the volatility of cryptocurrencies.

Even if your exchange did not provide you a Form 1099, you are still responsible for any taxable gains from your cryptocurrency trading. Although they are not legally obligated to send out 1099s just yet, the IRS won’t accept that justification if it finds out you made money trading cryptocurrencies. Make sure you’re claiming your losses and obtaining all tax benefits that you are legally entitled to while you’re at it. Here’s how to accurately declare your profits and losses on your tax return.

Lastly, keep in mind that you can have made a profit or a loss if you have spent cryptocurrency. Additionally, you can gain or create a tax liability from that, per the law.

6. Be Aware of K-1 Forms

You should be receiving a K-1 form outlining your tax situation, including whether you have received any distributions from the partnership, if you are an investor in a publicly traded partnership.

Since the K-1 form is not a 1099 and is, regrettably, frequently sent later in the tax season, it could be simple to overlook. Indeed, on occasion, it might even show up beyond the tax deadline. This implies that you will need to file an amended return if you have already filed your return. That can be annoying, but it’s not that hard, especially if you’re using tax software.

7. Make Tax Preparation Plans For 2024

Did you fail to sell your lost investments by the year-end deadline so you could claim a tax write-off? It’s one of the most significant ways for investors to lower their taxable income, and you won’t be able to deduct them from your taxes in 2025 if you don’t sell within the 2024 calendar year.

Thus, use this chance to assess whether you may lower your future taxes by selling certain losing investments now. Although a lot of investors wait until the last month of the year to sell a loser, it’s not required by law or tax law. Additionally, you might be able to avoid the inevitable last-minute rush when your life becomes even more stressful.

In Summary

There aren’t many options available to investors to actually lower their taxes once the year finishes. They do, however, have options to ensure that they are deducting all of the appropriate amounts. Furthermore, accurately and fully completing your tax form helps prevent the IRS from reviewing your return more closely than it already has.

-

Travel4 weeks ago

Travel4 weeks agoBwindi’s Gorilla Tourism: Saving Wildlife, Empowering Communities

-

Education4 weeks ago

Education4 weeks agoJoseph Curran: Using Legal Writing and Advocacy to Simplify Complex Issues for Clients

-

Tech4 weeks ago

Tech4 weeks agoGoogle Offers New Travel-related Features To Search And Launches Its AI “Flight Deals” Tool Around The World

-

Business4 weeks ago

Business4 weeks agoStop the Bleeding: How Unanswered Comments Increase Your CAC

-

Cryptocurrency2 weeks ago

Cryptocurrency2 weeks agoRami Beracha Asks, Can Israel Become A Global Leader In Blockchain Innovation?

-

Tech3 weeks ago

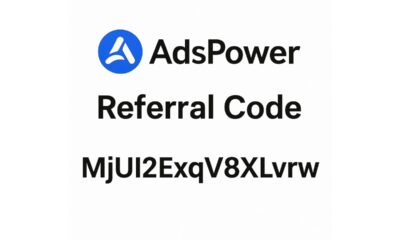

Tech3 weeks agoAdsPower Promo Code for 50% Off – Ultimate Guide to AdsPower Benefits (Referral Code Included)

-

Education2 weeks ago

Education2 weeks agoForged in Fire: Nicholas Lawless Unveils Lawless Leadership – The Model Built for a World That Traditional Leadership Can’t Survive

-

Business2 weeks ago

Business2 weeks agoOPO Group LTD Strengthens Its Global Footprint With Expanding Offices and a Modernized Trading Ecosystem