Startup

10 Important Guidelines That You Should Follow When It Comes to Personal Finance

The skill of managing one’s finances to meet financial goals and maintain financial well-being is known as personal finance. It entails creating a budget, saving, investing, and making wise choices regarding earnings and expenses. Important components include setting up an emergency fund for unanticipated events, managing debt strategically, and developing a budget to distribute money sensibly.

The two main elements that guarantee long-term financial security are retirement planning and insurance. A strong foundation is aided by ongoing financial education and comprehension of tax ramifications. Individuals who understand personal finance are better equipped to make wise decisions, accumulate wealth, and ensure a stable financial future.

It can be difficult to navigate the complicated terrain of income, expenses, and investments in the ever-changing world of personal finance. On the other hand, stability and financial success can be attained by following a set of tried-and-true guidelines. We’ll go over ten personal finance guidelines in this blog post aiming to enable readers to make wise options and create a stable financial future.

Setting a budget is essential. Budgeting is one of the core principles of personal finance. Making a monthly budget enables people to keep tabs on their earnings, organise their spending, and spot possible areas for savings. In the Indian context, with its varied spending habits and cultural quirks, a carefully designed budget acts as a guide for budgetary restraint. A balanced financial life is ensured by setting aside a portion of income for savings, discretionary spending, and necessary expenses.

Emergency fund: Having an emergency fund is essential in a nation where economic uncertainty is common. Financial stability can be impacted by unforeseen circumstances such as unexpected medical costs, job loss, or emergencies. Try to accumulate three to six months’ worth of living expenses in an emergency fund specifically for that purpose. In hard times, this financial cushion serves as a safety net and gives comfort.

Insurance is essential: Although it’s frequently disregarded, insurance is essential for protecting one’s financial security. Property, life, and health insurance are necessary parts of an all-encompassing financial plan. A sufficient amount of coverage protects you and your family’s finances by preventing unanticipated events from plunging you into financial ruin.

Pay off debts wisely: One of the most important aspects of personal finance is debt management. Even though all debts are not bad, it is important to prioritize paying off high-interest debts, such as credit card balances. Paying off these debts ought to be a top priority because of the interest rate burden. Low-interest debts, on the other hand, such as home loans, can be strategically managed in light of their possible tax advantages.

Invest early and wisely: Time is of the essence when using the compounding power. Even if you only have a small amount to invest, start early. Recognize the trade-off between risk and return, and spread your investments over a range of asset classes. Depending on personal risk profiles and financial objectives, options such as mutual funds, Public Provident Fund, and Equity-Linked Saving Schemes (ELSS) can be explored.

Retirement planning: It’s common for family support to take precedence over other considerations in a culture that values it. However, to preserve financial independence in later life, it is imperative to accumulate a retirement corpus. To ensure a comfortable post-retirement life, invest in retirement-focused instruments such as the National Pension System (NPS), Employees’ Provident Fund (EPF), or Public Provident Fund (PPF).

Remain up to date on tax planning; the Indian tax system is complex and dynamic. Keeping up with tax exemptions and savings options is essential to making the most out of your financial plan. To reduce your tax liability and increase your savings, take advantage of tax-saving options such as the National Pension System, Equity-Linked Savings Scheme, and tax-saving fixed deposits.

Learning never stops: Developing financial literacy takes time. Keep up with the most recent developments in the financial industry, investment opportunities, and regulatory changes. To expand your knowledge and make wise decisions, go to workshops, study financial publications, and consult with financial professionals.

Plan for major life events: Financial objectives range greatly, from purchasing a home to paying for your child’s education to organizing a dream vacation. Establish reasonable deadlines and methodically save money to create a plan for accomplishing these objectives. Examine investment options in line with your objectives to make sure you have enough money saved for important life events.

In summary, it takes a combination of knowledge, discipline, and strategic decision-making to become an expert in personal finance. Financial success in India can be achieved by following these ten personal finance rules, as cultural and economic factors are important. Every guideline, from prudent investing to budgeting, helps to create a stable financial future. By adhering to these guidelines, people can confidently negotiate the challenges of personal finance and eventually realize their financial ambitions.

-

Travel4 weeks ago

Travel4 weeks agoBwindi’s Gorilla Tourism: Saving Wildlife, Empowering Communities

-

Education4 weeks ago

Education4 weeks agoJoseph Curran: Using Legal Writing and Advocacy to Simplify Complex Issues for Clients

-

Tech4 weeks ago

Tech4 weeks agoGoogle Offers New Travel-related Features To Search And Launches Its AI “Flight Deals” Tool Around The World

-

Business4 weeks ago

Business4 weeks agoStop the Bleeding: How Unanswered Comments Increase Your CAC

-

Cryptocurrency2 weeks ago

Cryptocurrency2 weeks agoRami Beracha Asks, Can Israel Become A Global Leader In Blockchain Innovation?

-

Tech3 weeks ago

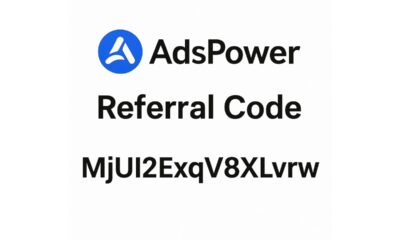

Tech3 weeks agoAdsPower Promo Code for 50% Off – Ultimate Guide to AdsPower Benefits (Referral Code Included)

-

Education2 weeks ago

Education2 weeks agoForged in Fire: Nicholas Lawless Unveils Lawless Leadership – The Model Built for a World That Traditional Leadership Can’t Survive

-

Business2 weeks ago

Business2 weeks agoOPO Group LTD Strengthens Its Global Footprint With Expanding Offices and a Modernized Trading Ecosystem